Many folks, you know, still wonder about FTX. It was, after all, a pretty big name in the world of digital money, and then it seemed to vanish almost overnight. That, honestly, left a lot of people scratching their heads and, in some cases, feeling quite worried about their investments. So, it's a really important question to ask: is FTX still around in any meaningful way these days?

The sudden turn of events for FTX certainly caused a stir, creating a lot of uncertainty and, you know, a fair bit of confusion for many. People had put their trust, and their funds, into this platform, expecting it to be a reliable place for their crypto activities. So, to see it all come crashing down, that was a truly unsettling experience for countless individuals across the globe, actually.

Just as understanding the difference between words like "do" and "does" is quite important for clear communication, figuring out the true state of FTX now requires a careful look at what’s actually happening. It’s not just a simple yes or no answer, you see. There are many layers to consider when we talk about whether something like FTX, a big financial operation, still "exists" in a practical sense, or if it's just a name from the past, you know.

Table of Contents

- The Big Collapse: What Went Wrong?

- FTX in Bankruptcy: What That Means

- The Legal Side of Things

- What About the FTX Brand Name?

- Can Customers Expect Their Money Back?

- Lessons Learned from the FTX Saga

- Frequently Asked Questions About FTX

The Big Collapse: What Went Wrong?

Well, to really get a handle on whether FTX still exists, we first need to briefly remember what happened when it all fell apart, you know, back in late 2022. It was a rather swift and, honestly, shocking downfall for what was then one of the biggest cryptocurrency exchanges anywhere. The company, which had been valued at billions, suddenly faced a massive cash crunch, and that led to a lot of panic, as you can probably imagine.

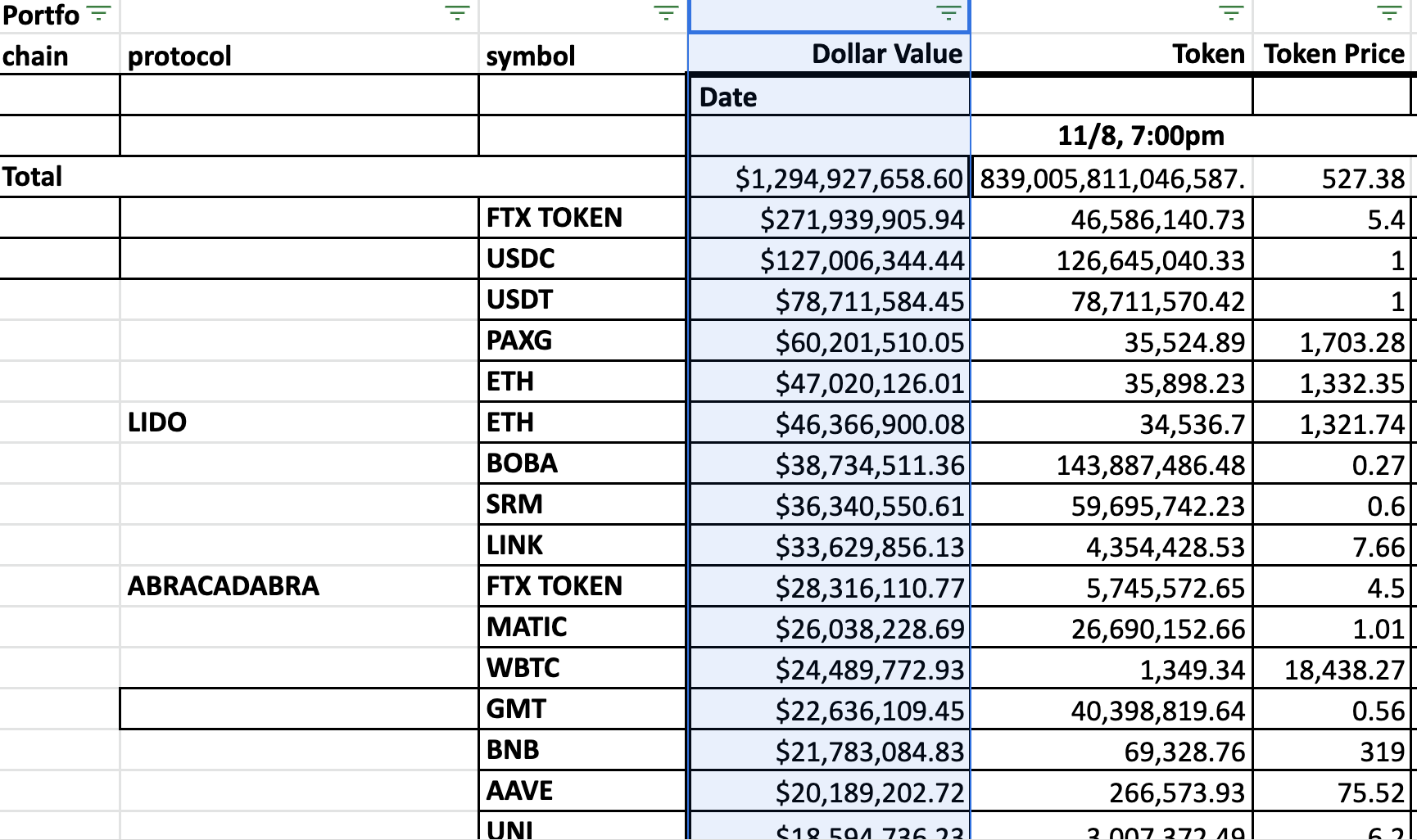

Reports started coming out that FTX had been using customer funds in ways that were, frankly, not allowed, particularly by sending them to its sister trading firm, Alameda Research. This, you know, created a huge hole in its finances. When customers tried to take their money out all at once, FTX simply couldn't pay them back. It was, basically, a classic bank run scenario, but in the world of digital assets, you see.

The founder, Sam Bankman-Fried, who had been seen as a bit of a crypto whiz, stepped down, and the company quickly filed for bankruptcy protection in the United States. That move, you know, was a really clear sign that the operational side of FTX as we knew it was pretty much over. It wasn't just a small hiccup; it was a total shutdown of its trading services for most people, more or less immediately.

FTX in Bankruptcy: What That Means

So, when a company like FTX goes into bankruptcy, it doesn't just disappear completely, you know, like smoke. Instead, it enters a very structured legal process, often called Chapter 11 in the U.S., which is designed to, you know, sort out its debts and assets. This process aims to give creditors—the people or companies FTX owed money to—the best possible chance of getting some of their funds back, which is, honestly, a huge undertaking.

During this period, FTX, the legal entity, certainly still exists, but it's not operating as a normal business. It's under the supervision of a court, and its primary goal shifts from making money to, basically, figuring out what it owns and what it owes. This is a very, very different kind of "existence" than what most people think of when they ask if a company is still around, you know.

The goal of bankruptcy, in this context, is to liquidate assets or reorganize the business in a way that pays back as many people as possible. It's a lengthy, complex journey, and it means that the FTX trading platform, as users once knew it, is not open for business. You can't, for instance, log in and trade crypto there anymore, which is a pretty clear sign of its non-operational status, actually.

The New Folks in Charge

When FTX went into bankruptcy, a new team, led by a very experienced individual named John Ray III, stepped in to take control. This gentleman has a long history of handling huge corporate collapses, including Enron, so he knows a thing or two about these sorts of situations. His job, quite simply, is to oversee the bankruptcy proceedings and try to recover as much money as possible for the people who lost it, you know.

This new management is not, you know, trying to revive the old FTX as a trading platform. Their mission is purely about asset recovery and distribution. They are, basically, like financial detectives, sifting through mountains of records to find where the money went and how to get it back. It’s a painstaking process that takes a lot of time and effort, so it's not something that happens overnight, you see.

So, when you ask "Does FTX still exist?", it's really important to distinguish between the operational company and the legal entity in bankruptcy. The latter certainly does exist, under new leadership, but its purpose is entirely different from what it was before. It's, you know, a very different kind of beast these days, more or less a clean-up crew.

Hunting for Assets and Money

A big part of the bankruptcy process involves the new management team working tirelessly to find and secure all of FTX's assets. This includes everything from bank accounts to digital currencies held in various places, and even, you know, real estate or other investments. It's a bit like a huge treasure hunt, but with legal documents and digital ledgers instead of maps, so.

They've been quite successful in recovering a significant amount of funds, which is, honestly, good news for the people who are owed money. However, it's a really challenging task because some assets were moved around or, you know, simply mishandled before the collapse. So, it's not always straightforward to track everything down, which is a bit of a hurdle.

The team also has to deal with various legal claims and disputes from different groups of creditors, all wanting their share. This, you know, adds another layer of complexity to the recovery efforts. It's a slow and steady process, but the aim is clear: to maximize the pool of money available for distribution, which is, you know, the main objective right now.

The Legal Side of Things

Beyond the bankruptcy court, there are also serious legal proceedings taking place related to FTX's collapse. The former founder, Sam Bankman-Fried, was, you know, charged with various crimes, including fraud, and has been through a trial. This is a completely separate but related aspect of the FTX story, highlighting the alleged misconduct that led to the company's downfall, you see.

These legal cases are, basically, about accountability and justice. They aim to determine if laws were broken and to hold individuals responsible for their actions. While these proceedings don't directly impact whether FTX the trading platform is operational, they certainly shape the public's perception of the name and, you know, what happened there, more or less.

The outcomes of these trials and investigations could also, in a way, influence the bankruptcy proceedings, especially regarding how certain assets are viewed or how much is ultimately recovered. It’s all, you know, part of the very complex aftermath of such a large financial failure. This legal scrutiny, honestly, continues to cast a long shadow over the FTX name.

What About the FTX Brand Name?

The name "FTX" itself, you know, still exists, but its meaning has changed dramatically. It used to stand for a thriving, innovative crypto exchange, but now it's largely associated with a massive financial scandal and bankruptcy. It's a bit like a famous building that's been torn down; the address might still exist, but the original structure is gone, you know.

There have been some discussions, perhaps, about whether the FTX brand or its underlying technology could ever be sold off or repurposed. However, given the severe damage to its reputation, it's hard to imagine it being revived in its previous form, or even, you know, as a trusted name in the immediate future. The negative associations are, honestly, very strong.

So, while the letters F-T-X are still around, they don't represent a functioning business where you can trade cryptocurrencies. They represent a legal entity in the midst of a complex, court-supervised process of asset recovery and creditor repayment. It's a name, basically, that now carries a lot of baggage, and that's just how it is, actually.

Can Customers Expect Their Money Back?

This is, perhaps, the most pressing question for many people who had funds on FTX. The goal of the bankruptcy proceedings, as we've discussed, is to recover assets and then distribute them to creditors, which include former customers. The new management has, you know, been working very hard to find and secure these funds, and they have made significant progress, apparently.

However, getting money back is a very, very lengthy process. It involves filing claims, verifying balances, and then waiting for the court to approve a distribution plan. It's not like a quick refund, you know. The exact percentage of funds that customers will eventually get back is still not entirely certain, but the team is aiming for a high recovery rate, so.

It's important for former customers to stay informed through official channels regarding the bankruptcy proceedings. There are specific websites and legal notices where updates are provided. This is, you know, the only reliable way to know about the progress of repayments. You can learn more about the official FTX bankruptcy proceedings on their dedicated website, which is a key resource for updates.

Lessons Learned from the FTX Saga

The collapse of FTX has, honestly, taught the crypto world and financial regulators some very tough lessons. It highlighted the critical importance of transparency, proper financial management, and strong oversight in the digital asset space. It showed, you know, what can happen when these things are not in place, which is a bit scary.

For individuals, it reinforced the message that you should always be very careful about where you keep your digital assets. The saying "not your keys, not your crypto" became, basically, a widely repeated mantra after the FTX situation. It means that if you don't control the private keys to your digital money, it's not truly yours, you see.

This whole episode has also, in a way, pushed regulators around the world to think more seriously about how to protect consumers in the crypto market. It's likely to lead to more rules and stricter enforcement in the future, which could be a good thing for long-term stability. The industry, you know, is definitely learning from this difficult experience, more or less.

Frequently Asked Questions About FTX

Many people have similar questions about FTX's current situation. Here are a few common ones, you know, that come up quite often:

Is FTX still operating?

No, the FTX trading platform, as a place where you can buy and sell cryptocurrencies, is not operating. It shut down when the company filed for bankruptcy in November 2022. So, you can't, you know, log in and make trades or manage your funds there anymore, which is a pretty clear answer to that, actually.

Can I get my money back from FTX?

The bankruptcy team is working to recover assets and aims to distribute them to former customers and other creditors. It's a lengthy legal process, and while significant funds have been found, the exact amount and timing of repayments are still being determined. So, it's not a quick process, but there is, you know, a clear effort to return funds, apparently.

What happened to FTX?

FTX, a major cryptocurrency exchange, collapsed in late 2022 due to alleged misuse of customer funds and poor financial management. It filed for bankruptcy, and its founder, Sam Bankman-Fried, faced legal charges. The company, you know, simply ran out of money to meet customer withdrawals, leading to its downfall, and that's just how it is.

We hope this has helped clarify the situation around FTX. For more insights on financial topics and how to protect your assets, you know, you can learn more about financial security on our site. And if you're curious about the broader impact of such events on the digital economy, you might also find this page exploring market stability quite interesting.

Detail Author:

- Name : Prof. Dayton Lowe II

- Username : fabian94

- Email : casper.marlee@gleichner.com

- Birthdate : 1980-03-19

- Address : 7177 Olga Gateway Suite 338 Kshlerinside, OK 54786

- Phone : +1.860.864.6405

- Company : Franecki Inc

- Job : Mechanical Engineering Technician

- Bio : Voluptates rerum ea nisi aut sit est adipisci illo. Incidunt et nobis aut et nihil voluptatem unde. Quam praesentium iusto vel omnis non.

Socials

instagram:

- url : https://instagram.com/huldalangosh

- username : huldalangosh

- bio : Explicabo voluptas sed beatae autem minus qui vel. Est vero ut repudiandae laudantium.

- followers : 740

- following : 1742

twitter:

- url : https://twitter.com/huldalangosh

- username : huldalangosh

- bio : Sint tempore ullam saepe atque. Et consequatur tenetur quo magnam molestiae sit qui. Ut quis in quod aut dolor.

- followers : 5008

- following : 2514