Thinking about doing your taxes online this year? You are probably wondering, like your neighbors, what the costs might be. It's a fair question, really. Finding out exactly how much H&R Block charges to do taxes online can feel a bit like trying to solve a puzzle, especially with all the different choices out there.

There are a few things that play a part in the final price you might see. It's not just one fixed amount for everyone, you know. Your personal tax situation, the kinds of income you have, and the deductions you want to claim all make a difference.

This guide will help you get a clearer picture of what to expect. We'll break down the different options H&R Block offers, talk about what each one typically covers, and give you some ideas on how to pick the right fit for your pocketbook. So, you can feel pretty confident about your choice.

Table of Contents

- Understanding H&R Block's Online Tax Options

- What Makes the Price Tag Change?

- Tips for Getting the Best Value

- Common Questions About H&R Block Online Charges

Understanding H&R Block's Online Tax Options

H&R Block offers a few different ways to get your taxes done online, and each one comes with its own price tag. It's almost like picking a plan for your phone, where some plans are basic and others have all the bells and whistles. Knowing which one fits your needs is key to figuring out the cost, you know.

They usually have a free option, then a couple of paid ones that offer more features, and sometimes a specialized one for folks with very particular income sources. It really just depends on what your personal financial picture looks like for the year.

The Free Online Edition: What's Included?

The Free Online Edition from H&R Block is, well, free for federal filing, and that's a pretty big deal for some people. This version is typically good for very simple tax situations. We're talking about folks who might only have W-2 income, claim the standard deduction, and perhaps have a few common credits, like the Earned Income Tax Credit or the Child Tax Credit.

If your tax life is pretty straightforward, this could be a great choice. You won't pay a penny for your federal return, which is actually quite nice. It allows you to enter your basic income and deductions without any charges. However, it's worth noting that state filing often comes with a separate fee, even with the free federal option. So, that's a little something to keep in mind.

This free version is perfect for students or those with just one job and no other income sources, for instance. It helps them get their basic filing done without any financial burden for the federal part. It's a simple, no-frills way to get the job done, and it's pretty popular for that reason.

Stepping Up: Deluxe and Premium Choices

When your tax situation gets a bit more involved, you'll likely need to consider one of H&R Block's paid online editions, such as Deluxe or Premium. These versions offer more forms and guidance for more complex scenarios. It's like moving from a basic car to one with more features, really.

The Deluxe edition is often a good fit for homeowners or those with investments. This version typically handles things like itemized deductions, which are common for people who own a house and pay mortgage interest or property taxes. It also helps with health savings accounts (HSAs) and some investment income, like interest and dividends. The price for Deluxe can vary, but it's usually in a moderate range, giving you more options than the free version without being the most expensive.

Then there's the Premium edition, which is designed for even more involved situations. This one is typically for people who sell stocks, bonds, or other investments, or those with rental property income. It provides the necessary forms and support for these types of earnings. The cost for Premium is, as you might guess, higher than Deluxe, reflecting the added complexity and features it provides. It's for people with a bit more going on in their financial lives, so it actually makes sense that it costs a bit more.

Both Deluxe and Premium offer more help and tools compared to the free version. They often include things like audit support or access to tax advice, though the level of support can differ. You're paying for the ability to handle more types of income and deductions, which can sometimes lead to a larger refund if you claim everything correctly. It's about getting the right tools for the job, you see.

Self-Employed and Beyond: Specialized Editions

For individuals who are self-employed, freelancers, or independent contractors, H&R Block offers specialized online editions that cater to their unique tax needs. These editions are designed to handle business income and expenses, which can be quite different from regular W-2 earnings. They are, in a way, built for people who are their own bosses.

The Self-Employed edition is usually the top-tier option for individuals. It helps with Schedule C (Profit or Loss from Business), which is essential for reporting self-employment income and deducting business expenses. This can include things like home office deductions, business travel, and supplies. The price for this edition is typically the highest among the individual online offerings, reflecting the advanced features and forms it provides. It's pretty comprehensive for small business owners.

Sometimes, there might be other specialized versions for specific situations, like those with farm income or certain types of partnerships, but the Self-Employed edition covers the vast majority of independent workers. These editions help you find all the possible deductions related to your business, which can significantly lower your taxable income. So, while it costs more upfront, it could save you money in the long run. It's a very practical choice for many.

These specialized tools help ensure that self-employed individuals can properly report their earnings and take advantage of all eligible write-offs. They are designed to make what can be a very complicated process a bit simpler. You get the specific forms and guidance you need, which is definitely a plus. It's almost like having a personal assistant for your business tax matters.

What Makes the Price Tag Change?

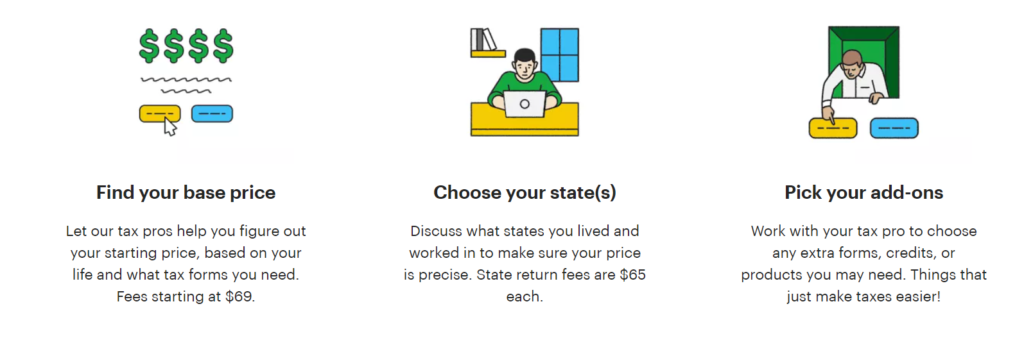

The amount you pay for H&R Block's online tax services isn't just about which edition you pick. There are other things that can make the price go up or down, or so it seems. Understanding these extra bits can help you avoid surprises when you get to the payment screen.

It's not just a flat fee, you see. Your specific tax situation, whether you need extra help from a person, and where you live all play a part. So, let's talk a little about those factors.

Your Tax Situation: A Big Factor

The kind of income you have, and the deductions or credits you plan to claim, are probably the biggest drivers of the cost. If your financial life is fairly simple, with just a W-2 and maybe some bank interest, the free version might be just fine for you. This means a lower cost, or no cost at all for federal filing, which is pretty good.

However, if you have things like investment sales (stocks, bonds), rental property income, or if you're a freelancer with business expenses, you'll need a higher-tier product. These situations require more complex forms and calculations, and the online software provides those. For example, if you sold some shares, you'll need to report capital gains or losses, and that usually pushes you into a Deluxe or Premium edition. This means the price goes up, naturally.

Claiming itemized deductions, rather than the standard deduction, also often means you'll need a paid version. If you have a lot of medical expenses, charitable contributions, or state and local taxes that add up to more than the standard deduction, you'll want to itemize. The software helps you figure all that out, but it typically comes with a cost. So, it's pretty clear that what you put on your return directly affects the price.

The more "stuff" you have to report, the more features you'll likely need from the software, and that's where the different editions come in. It's about matching the tool to the task, and sometimes the task requires a more advanced tool. This is why it's a good idea to gather all your tax documents before you start, so you have a clear picture of what you'll need to report. That way, you can get a better estimate of the cost from the start.

Adding Expert Help: Live Support and Review

H&R Block offers options to get help from a tax professional, even when you're doing your taxes online. This can be a really helpful feature for some people, but it does add to the overall cost. It's like having a safety net, if you will, but one that you pay a little extra for.

One common option is "Tax Pro Review." With this service, you prepare your tax return using the online software, and then an H&R Block tax expert reviews it before you file. They check for errors, look for missed deductions, and generally make sure everything looks correct. This can provide a lot of peace of mind, especially if you're not entirely confident in your own tax-filing abilities. The price for this service is an additional fee on top of the cost of the online edition you choose. It can be a significant addition, but many people find it worthwhile for the assurance it provides.

Another level of support is "Tax Pro Help" or similar live assistance options. This might involve direct chat, phone calls, or even screen-sharing with a tax professional as you prepare your return. This kind of hands-on help is for when you get stuck on a particular question or need guidance on a specific tax situation. Like the review service, this comes with an extra charge. It's a bit like having a tutor available when you need one, and that often costs a bit more.

These services are great for those who want the convenience of online filing but also want the confidence that comes from professional eyes on their return. The cost varies based on the level of help you choose and the complexity of your return. So, if you think you might need some human guidance, factor that into your budget. It's a way to get personalized support without visiting an office in person, which is pretty convenient for many folks.

State Filing: An Extra Consideration

When you're figuring out how much H&R Block charges to do taxes online, it's very important to remember state filing. While federal filing might be free or a certain price, state taxes are almost always a separate charge. This is a pretty common thing across most online tax services, actually.

Each state has its own tax laws and forms, so preparing a state return is like doing a whole separate mini-tax return. H&R Block charges a fee for each state return you need to file. This fee is added on top of whatever you pay for your federal return. So, if you live in a state with income tax, you'll definitely see an extra line item for that. It's pretty standard, really.

The cost for state filing can vary a little from state to state, but it generally falls within a certain range. If you lived in one state for part of the year and then moved to another, you might even need to file in two different states. In that case, you'd pay a fee for each state return, which can add up. It's something to be very aware of when you're budgeting for your tax preparation.

Sometimes, there might be promotions where state filing is included or discounted, but these are usually temporary offers. So, it's a good idea to assume there will be a state filing fee unless you specifically see an offer that says otherwise. Always check the current pricing on H&R Block's website to get the most accurate figures for your situation. It's the best way to avoid any surprises later on, you know.

Tips for Getting the Best Value

Finding the right balance between cost and features when doing your taxes online is something many people aim for. You want to get your taxes done correctly without spending more than you need to. There are a few simple things you can do to try and get the best deal from H&R Block, or any online tax service, for that matter.

It's about being smart with your choices and knowing what's available. So, let's talk about some ways to save a little money, or at least make sure you're not paying for things you don't really need.

Knowing Your Needs Before You Start

One of the best ways to save money is to figure out exactly what kind of tax situation you have before you even pick an H&R Block online edition. This means gathering all your tax documents first. Get your W-2s, 1099s for interest or dividends, any forms for self-employment income, and information about deductions like mortgage interest or student loan interest. This is a very important first step.

Once you have everything laid out, you can pretty easily determine if your situation is simple enough for the free edition, or if you'll need a paid version like Deluxe, Premium, or Self-Employed. For example, if you only have a W-2 and plan to take the standard deduction, the free option is probably all you need. Paying for Deluxe would be a waste of money in that case, wouldn't it?

If you own a home and want to itemize deductions, or if you have investment income, you'll likely need Deluxe or Premium. If you're a freelancer, the Self-Employed edition will be your go-to. Knowing this upfront prevents you from starting with one version and then having to upgrade later, which can sometimes be a bit confusing or lead to unexpected charges. So, a little preparation can save you time and money, actually.

Many online tax services, including H&R Block, let you start your return for free and only ask for payment when you're ready to file. This means you can begin entering your information and see if the software prompts you for an upgrade based on the forms you need. This is a good way to test the waters and confirm which edition is right for you before committing to a payment. It's a smart approach, really.

Looking for Discounts and Promotions

Throughout tax season, H&R Block, like many other tax software providers, often offers discounts and promotions. Keeping an eye out for these can help you reduce the amount you pay to do your taxes online. These deals can pop up at different times, so it's worth checking back, or so it seems.

Sometimes, you'll find early-bird specials at the beginning of tax season. These are for people who get their taxes done early. Other times, there might be special offers around holidays or specific periods. These promotions can include a percentage off the federal filing fee, a discount on state filing, or even bundles that include both federal and state returns for a lower combined price. It's pretty common for them to do this.

You might find these promotions directly on the H&R Block website. It's a good idea to check their homepage or a dedicated "offers" section. Also, sometimes financial websites or coupon sites will list current deals. If you're a student or in the military, there might be specific discounts available for you as well, so always check for those if they apply. It never hurts to ask, or look, for a better deal.

Signing up for H&R Block's email list might also give you access to exclusive discounts. They often send out notifications about sales or special pricing to their subscribers. So, a little bit of searching or signing up for updates can really pay off when it comes to saving some money on your tax preparation. It's a simple step that could make a difference, you know.

Free Resources You Can Use

Even if you choose a paid H&R Block online edition, there are still many free resources you can use to help you prepare your taxes and potentially save money. These resources won't directly lower the H&R Block fee, but they can help you feel more confident and avoid paying for extra services you might not need. It's about being resourceful, you see.

The IRS website is a treasure trove of free information. You can find publications, forms, and instructions for almost any tax situation. If you have a specific question about a deduction or a credit, checking the IRS website first can often give you the answer without needing to pay for expert advice from H&R Block. It's a very reliable source, actually.

Detail Author:

- Name : Prof. Rey Deckow II

- Username : landen58

- Email : jessy.huel@goodwin.info

- Birthdate : 1989-09-08

- Address : 48984 Murazik Rapid Barrowsberg, IA 10042-3612

- Phone : 1-707-801-4233

- Company : Bins, Little and Nikolaus

- Job : Coating Machine Operator

- Bio : Officia ea placeat expedita molestias iure hic. Vel non numquam sit nisi deserunt qui similique quia. Consequuntur ab sed aliquid. Est aut temporibus eum in.

Socials

facebook:

- url : https://facebook.com/corine_reinger

- username : corine_reinger

- bio : Tempora minus et ut et fugiat. Qui quae omnis eum blanditiis deleniti.

- followers : 3660

- following : 1101

tiktok:

- url : https://tiktok.com/@corine_official

- username : corine_official

- bio : Dolor corporis reiciendis rerum aut omnis magnam.

- followers : 3339

- following : 2707